A business expansion story becomes newsworthy long before the ribbon is cut or the press release lands in inboxes. Editors usually sense it earlier, in the shape of the numbers, the timing, and the people behind the move. Expansion, by itself, is not news. Businesses are supposed to grow. What makes it worth covering is when growth intersects with consequence — for workers, competitors, customers, or a specific place on the map.

Newsrooms tend to ask a blunt first question: who is affected? A company opening a second office rarely qualifies. A company bringing 800 jobs into a manufacturing town that lost its largest employer does. Scale changes everything. So does specificity. “We are expanding globally” is public relations language. “We are building a 200,000-square-foot facility outside Pune and shifting 30% of production there by March” is news language. One is intention. The other is commitment.

There is also the matter of proof. Editors and reporters are trained to separate declared growth from demonstrated growth. A planned expansion funded by projected revenue draws caution. An expansion backed by secured financing, signed leases, construction permits, and named hires draws attention. Documents make expansion real. Without them, it reads like optimism dressed as strategy.

Timing plays a larger role than companies expect. Expansion during an industry downturn attracts coverage because it contradicts prevailing sentiment. Expansion during a boom often needs a sharper angle to stand out. When everyone is growing, growth stops being distinctive. A logistics firm adding routes during a supply chain slowdown says something different than the same move during record shipping demand. Context supplies the voltage.

Local impact remains one of the most reliable hooks. Regional publications and business desks still track employment shifts closely, even when national outlets focus on valuations and venture rounds. A mid-sized company doubling its headcount in a tier-two city can receive more serious press coverage than a larger company adding marginal staff in an already saturated tech hub. Reporters know their readers recognize streets and industrial parks more readily than abstract market share.

Leadership credibility often tips the scale. Expansion led by an executive with a track record of disciplined delivery carries weight. Expansion led by a founder known for overpromising raises skepticism and invites sharper questioning. Journalists remember patterns. So do editors. A CEO who has executed two previous rollouts on schedule gets the benefit of attentive coverage. One who missed targets becomes part of the story.

There is also a narrative preference for expansion that solves a visible problem. When a health-tech company scales into rural diagnostics, or a clean-energy manufacturer increases battery output during grid instability, the move connects to a public concern. It stops being internal corporate news and becomes social infrastructure news. The best business PR news understands this bridge and builds its messaging around real-world effects rather than internal milestones.

Money alone is rarely enough, despite what announcement drafts suggest. Funding rounds used to guarantee press coverage. Now they compete with dozens announced each week. The amount matters less than the use. Reporters want to know what expansion capital will actually do — hire engineers, build plants, acquire competitors, lower prices, enter regulated markets. Use of funds is more interesting than size of funds.

Specifics create credibility, and credibility creates coverage.

I once noticed that the most compelling expansion briefings included uncomfortable details alongside the celebratory ones.

Risk is part of the story when companies are honest enough to acknowledge it. Entering a new country means regulatory friction. Scaling production means supply vulnerability. Hiring fast means culture strain. When executives speak plainly about trade-offs, journalists listen more carefully. It signals maturity and reduces the scent of promotional spin. Press coverage improves when the company sounds less like a campaign and more like a decision-maker.

Physical visibility helps. A new factory, research center, logistics hub, or data center provides images, site visits, and tangible reference points. Reporters can stand somewhere, look around, and describe what is happening. Virtual expansions — platform upgrades, backend scaling, cloud migrations — are harder to make vivid unless paired with customer or market effects. Tangible change travels better in print and on screens.

Partnerships can elevate an otherwise routine expansion into a noteworthy one. A regional retailer expanding with the backing of a global distribution partner shifts competitive dynamics. A software firm entering healthcare with a hospital network changes credibility overnight. Names matter. Associations act as shortcuts for readers trying to judge significance quickly. Editors know recognizable partners increase reader trust and curiosity.

Data exclusivity is another quiet driver. If a company can offer first access to verified numbers — hiring projections, export targets, production capacity, contract volumes — coverage becomes more likely and more detailed. Exclusive or early data gives journalists something defensible to publish beyond corporate adjectives. Vague projections invite short mentions. Concrete figures invite full stories.

Expansion stories gain further traction when they signal a category shift rather than a company shift. If one firm expands into AI-assisted logistics, that is interesting. If three competitors do it within a quarter, it becomes a trend piece. Reporters are trained to zoom out. They look for patterns, not isolated motion. Smart communicators frame their expansion within broader industry movement without claiming to represent the entire wave.

Language choices influence whether an announcement feels like business PR news or business reporting. Words like “ecosystem,” “synergy,” and “leveraging” trigger editorial fatigue. Plain verbs — build, hire, ship, open, acquire — survive editing. So do numbers tied to deadlines. Specific months beat vague quarters. Named locations beat regions. Identified roles beat “talent.”

There is also the question of who is willing to speak on the record. Expansion stories strengthen when customers, suppliers, local officials, or independent analysts confirm the significance. Third-party voices reduce promotional bias. A mayor discussing zoning approvals, a supplier describing increased orders, or a client confirming new service capacity adds texture that a company quote cannot.

Not all expansions deserve applause, and journalists know it. Some are defensive moves framed as growth — consolidations labeled as optimization, relocations labeled as market access. When expansion masks retreat, scrutiny intensifies. Layoffs paired with overseas hiring raise different questions than net new employment. Good coverage does not ignore contradictions.

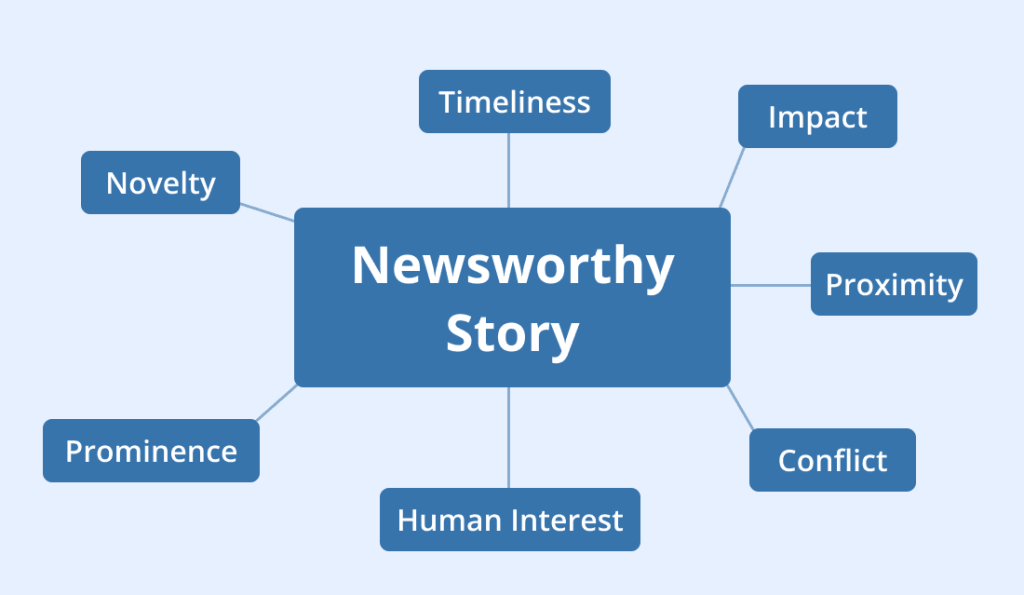

Ultimately, what makes an expansion story newsworthy is consequence plus credibility plus clarity. Consequence answers who feels the impact. Credibility answers why the claim should be believed. Clarity answers what exactly will change and when. Remove any one of the three and the story shrinks to a brief item or disappears entirely from the page.